CUBC Merchant (Mobile App) Agreement

1. INTRODUCTION TO THE AGREEMENT

The CUBC Merchant (Mobile App) Agreement (hereinafter referred to as the “Agreement”) between the Merchant “You” and Cathay United Bank (Cambodia) PLC. (hereinafter referred to as “CUBC”) in relating to the use of the CUBC Merchant (Mobile App) by you, the Merchant.

The terms and conditions will apply immediately at the time you click on “agree”, and you are deemed to accept these terms and conditions before you can use the service. It is important that you read these terms and conditions before you use the CUBC Merchant account.

By clicking on “agree” means that you agree to all terms and conditions in this Agreement and accept responsibility to establish your Merchant account with CUBC.

If you choose not to accept these terms and conditions or any of its revisions, please do not proceed further and immediately stop accessing and/or using CUBC Merchant (Mobile App).

2. DEFINITION

In this Agreement, the following words and phrases shall have the following meaning:

CUBC: Cathay United Bank (Cambodia) PLC.

CUBC Merchant (Mobile App): refers to the payment platform provided service by "CUBC" Cathay United Bank (Cambodia) PLC. This service enables Merchants to accept payments online through intra bank and cross Bakong payment in a variety of ways to process banking transaction and payment for customers.

CUBC IP (intellectual property) refers to any work or invention created by CUBC, including but not limited to CUBC Merchant portal, documentation, and all copyrights and any related technology used pursuant to this Agreement. This includes, but is not limited to, all intellectual property rights associated Merchant portal, and documentation.

Merchant: refers to a person or entity, who owns or operates a business and has successfully registered with CUBC's Merchant KHQR service to use the CUBC Merchant (Mobile App).

Non- Merchant Users: refers to a person or entity who is not registered as a Merchant with CUBC to use the CUBC Merchant (Mobile App)

Cashier: Refers to an individual authorized by Merchant who possesses a Username and Password to utilize the CUBC Merchant (Mobile App) on behalf of Merchant respond for accepting payments and receiving KHQR incoming transactions from customers.

Non- Cashier Users: refers to an individual not authorizes by Merchant to use the CUBC Merchant (Mobile App).

Mobile Devices: refer to devices, including but not limited to smartphones, tablets, and other devices with telecommunication and internet connection functions.

Mobile Application (hereinafter referred to as "mobile APP"): refers to any app installed on a mobile device.

QR Code Payment: refers to the contactless payment through bank transfer, which are conducted by scanning a QR scan from a Mobile App in compliance with the KHQR regulations from the National Bank of Cambodia.

Username: refers to a unique identifier created by Merchant or Cashier used for logging into access the Merchant account.

Password: refers to a confidential combination of characters, numbers, or symbols created to access to the Merchant account.

Dynamic QR Code: refers to a unique QR code generated by Merchant on CUBC Merchant (Mobile App) containing the information of the merchant and the price of the good or service that can be scanned by customers to initiate the transaction.

Static QR Code: refers to a unique QR code that contains fixed information generated by Merchant on CUBC Merchant (Mobile App) containing only the information of the Merchant that required for the customer to enter the purchase amount before initiate a transaction.

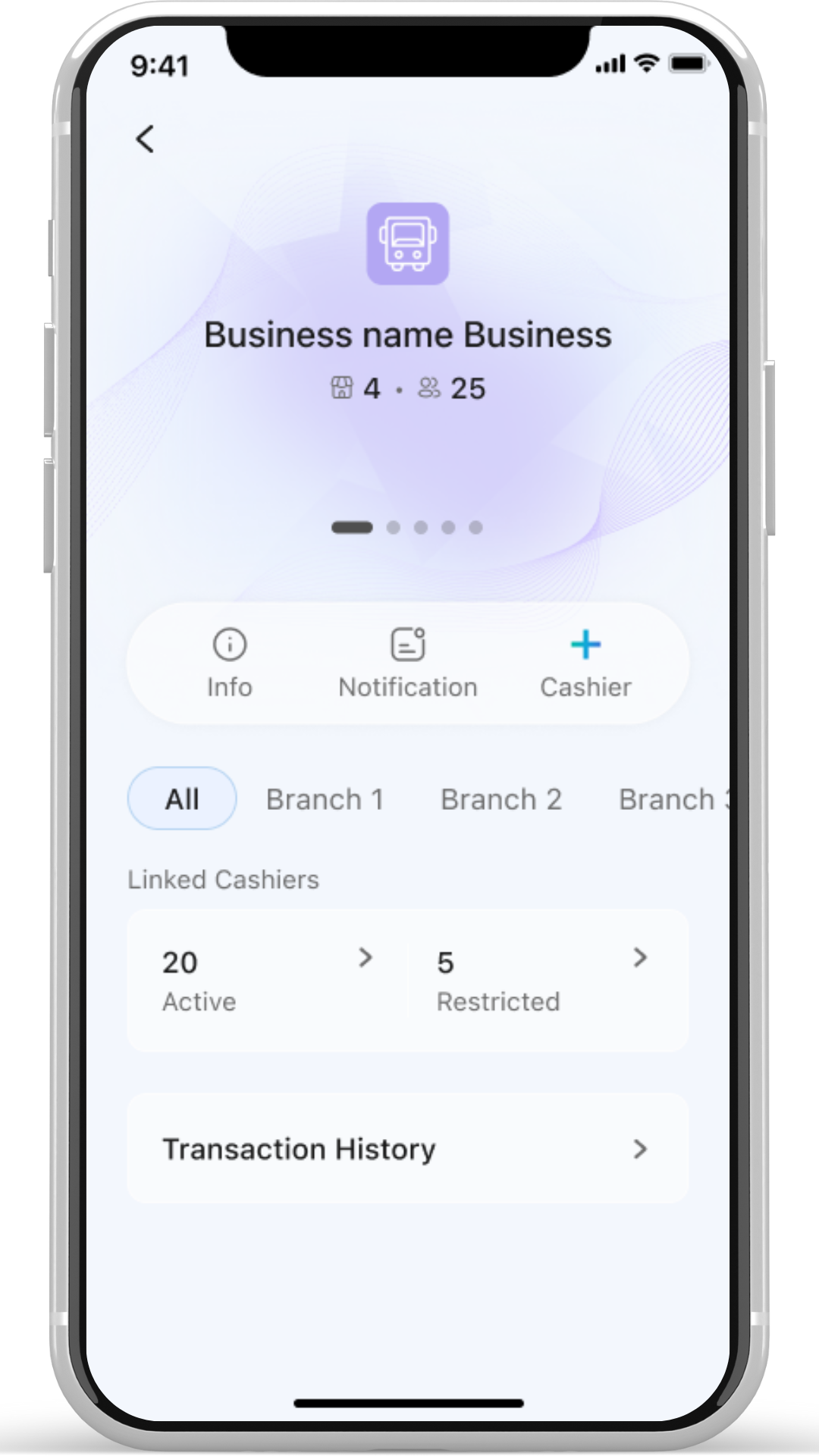

Business Management: refers to the function that allows Merchants to view, manage their registered businesses and branches, including the creation and management of Non-Cashier Users.

Transaction History: refers to the function that allows you to view total amounts and transaction, detailed transaction history for each of your active business branches.

QR Code Generation: refers to the generation of static and dynamic CUBC KHQR codes for receiving payments from customers.

Security Settings: refers to the function manage your account security settings, changing or resetting your PIN, registering biometric authentication (Face ID or Fingerprint), and changing or resetting your password.

3. MERCHANT OBLIGATIONS

Merchant shall be solely responsible for the security and confidentiality of their respective authentication credentials username, password, personal identification number (PIN), verification code, one-time password (OTP) used to access CUBC Merchant (Mobile App).

Merchant acknowledges and agrees to be solely responsible for the management and supervision of its cashiers and any personnel authorized to utilize the CUBC Merchant (Mobile App). Instructions initiated from the specified mobile number shall be deemed to have been authorized by Merchant. Furthermore, Merchant acknowledges that any and all instructions initiated from the mobile number registered with the CUBC Merchant (Mobile App) for this Merchant account must also match the mobile number registered when opening account with CUBC.

Merchant shall promptly notify the bank, in writing or through any other agreed-upon communication channel by contacting our customer service, of any loss, theft, or unauthorized use of the mobile device or mobile number associated with CUBC Merchant (Mobile App) event of any concern or issue in connection to Mobile App or service, Merchant shall request the bank to immediately suspend CUBC Merchant (Mobile App) service and/or change mobile number.

Merchant shall be solely responsible for monitoring and identifying any errors or discrepancies in transactions processed through CUBC Merchant (Mobile App) or reflected in Merchant’s bank account. Merchant agrees to promptly notify CUBC of any such errors or discrepancies. Upon receipt of such notification, CUBC shall investigate the matter and, if appropriate, take reasonable steps to rectify any error, including any error in application or transaction processing. However, Merchant’s failure to promptly notify CUBC of any error shall render Merchant solely liable for all losses, damages, and costs arising therefrom.

Merchant must inform CUBC in the form of a written notice within three (3) business days if any of the following occur:

• Any change occurs to the information submitted to CUBC in the application form can only be made at CUBC branch.

• Any change to the fundamental nature of the Merchant business, including the sale of any products or services not directly related to the Merchant current line of business, shall constitute a material breach of this agreement.

• Any change in the ownership or control of your business, including any termination of partnerships related thereto.

• Merchant dissolves, liquidates, or is adjudicated bankrupt.

• Any change occurs in the financial condition significant alteration in Merchant's financial status that could potentially impact their ability to fulfill their obligations ownership, financial difficulties, or changes in business operations.

• Any technical issue in connection with CUBC Merchant (Mobile App) can contact CUBC through communication channel by contacting our customer service.

In the event that Merchant fails to promptly notify CUBC of any of the matters specified herein, CUBC shall have the authority to suspend or terminate the Merchant's service without prior notice.

Merchant warrants and represents that all information provided to CUBC in connection with CUBC Merchant (Mobile App) and any other documents submitted to CUBC is accurate, complete, truthful and completely reflects Merchant business operations.

Merchant shall not use the Merchant functions, as specified in article 7, for any unlawful purpose.

By accepting this agreement, Merchant agrees to ensure that Cashier who have access to CUBC Merchant (Mobile App) are fully informed of and comply with the terms and conditions set forth in these general terms and conditions and other agreement previously executed by Merchant.

4. RESTRICTED ACTION

Merchant shall ensure that all information provided and all activities conducted through CUBC Merchant (Mobile App) do not:

• Be false, inaccurate, or misleading, and be connected to gambling, fraudulent, or counterfeit activities engage in any illegal activity, including but not limited to illegal money lending.

• Fails to comply with CUBC anti-money laundering obligations, including but not limited to failing to provide adequate identification or verification.

• Engages in any business or activity involving cryptocurrencies, digital assets, or other unregulated financial instruments, such as financial products or services that are not legally operated under Cambodian applicable laws.

5. CUBC ELIGIBILITIES AND OBLIGATIONS

CUBC shall provide Merchant with access to the CUBC Merchant (Mobile App) solely for the purpose of enabling to receive payment transactions. It is expressly understood and agreed that the CUBC Merchant (Mobile App) is not intended for, and does not provide, transfer services.

The CUBC Merchant (Mobile App) is accessible 24 hours a day, 7 days a week for the transmission of payment transactions. CUBC reserves the right to temporarily suspend access to the CUBC Merchant (Mobile App) for necessary maintenance, security updates, system repairs, upgrades, or other justifiable reasons at CUBC's sole discretion. CUBC will endeavor to provide advance notice of any such interruptions whenever feasible.

CUBC shall provide Merchant with not less than thirty (30) days' advance as a notice in any platform of any change to CUBC policies and procedures that may reasonably be expected to require action or cooperation on the part of Merchant.

CUBC shall notify to Merchant through communication channel related to issue reported by Merchant.

6. REGISTRATION AND VERIFICATION

• Merchant registration: must complete the registration process with CUBC, providing accurate and complete information for their merchant profile. Merchant may choose to utilize the CUBC Merchant (Mobile App) at their discretion.

• Identity verification: CUBC may require Merchant to undergo identity verification procedures, such as providing identification documents that submitted to CUBC.

7. APP ACCESS AND USE

The Merchant, you have access to the following functions:

• Business Management

• Transaction History

• QR Code Generation

• Security Settings

The Cashier, you have access to the following functions:

• Transaction History

• QR Code Generation

• Security Settings

Merchant and Cashier are responsible for maintaining the confidentiality of their login credentials and for all activities that occur under their account. you agree to notify CUBC immediately of any unauthorized use of your account or a breach of security.

You may not use the app for any unlawful or prohibited purpose, or in a way that could damage, disable, overburden, or impair the CUBC Merchant (Mobile App) or CUBC bank's systems.

8. MERCHANT TRANSACTIONS

You are solely responsible for all transactions conducted through Mobile App using your Merchant account. Merchant acknowledges and agrees that its employees may view customer payment information related to transactions processed through Merchant functions.

You agree to comply with all applicable laws, regulations, and CUBC policies and procedures related to Merchant transactions, including but not limited to anti-money laundering and counter-terrorism financing regulations.

CUBC reserves the right to review and monitor your transactions for compliance with the applicable laws and regulations.

You agree to comply with exchange rate fluctuations across currencies based on your account activity.

9. FEES AND CHARGES

You agree to pay fees if your account is not active for a period base on the account type from the creation date or the last transaction date, and become “dormant”.

You agree to pay an annual service fee that applicable fees will be communicated to you in advance.

You agree to pay all fees and charges as they become due.

10. PERSONAL INFORMATION AND CONFIDENTIALITY

You warrant that all information provided herein are truly accurate with further requirement by CUBC for providing necessary personal or business information in any case that you refuse or delay, you agree with the CUBC for suspending all or part of the service.

We take your privacy very seriously. All information that had been provided to CUBC will be kept strictly confidential and securely held by CUBC. If you choose to use these service, then you agree to the privacy policy of CUBC Merchant (Mobile App).

CUBC will make every effort to keep your personal information up to date. To assist us, please let us know of any changes information and business details.

CUBC maintains the security and confidentiality of your information. However, CUBC reserve the right to disclose this information to the appropriate authorities in accordance with Cambodian Laws and we may share related information (such information management) with Cathay Financial Group including but not limited to CUB and affiliated companies, and outsourced agencies entrusted by bank to handle affairs due to the needs of performing CUBC Merchant (Mobile App).

11. LIMITATION OF LIABILITY

CUBC shall not be liable for any indirect, incidental, special, consequential, or exemplary damages, including but not limited to lost profits, lost data, or business interruption, arising out of or in connection with Merchant use of Mobile App or the services provided through it.

Merchant shall be liable to CUBC for all losses, damages, costs, and expenses (including, without limitation, consequential losses) suffered or incurred by CUBC arising from or in connection with any fraud or negligence on the part of Merchant or any breach by Merchant of the CUBC Merchant (Mobile App).

Merchant acknowledges and agrees that any unauthorized reproduction, distribution, transmission, publication, or other exploitation of any proprietary information provided or available via the CUBC Merchant (Mobile App) and/or application, or any portion thereof, by Merchant is strictly prohibited. Merchant further acknowledges and agrees that any such unauthorized use may result in legal action, including but not limited to, injunctive relief, monetary damages, and other remedies available at law or in equity.

12. DISPUTES AND RESPONSIBILITY BETWEEN MERCHANTS, CUSTOMERS, AND CASHIERS

CUBC shall not be liable for any disputes between Merchant and their customers. Merchant are solely responsible for resolving such disputes directly with their customers.

CUBC shall not be liable for any disputes arising from:

• Errors in payment amounts resulting by Merchant error or mistake

• Failure of Merchant to provide goods or services to the customer, notwithstanding payment for such goods or services

• Merchant unavailability or inability to be contacted

• Any wrongful, fraudulent, or negligent act or omission by Merchant, including but not limited to miscommunications or errors in Merchant relationship with the customer(s) of the CUBC Merchant (Mobile App)

Merchant must ensure that any individual on boarded or designated as a cashier to use the CUBC Merchant (Mobile App) is at least 18 years of age and fully responsible for verifying the age and suitability of their Non-Cashier Users and for any actions taken by Cashier using Mobile App.

CUBC Merchant (Mobile App) does not offered a refund function. If a refund is required, it must be handled by Merchant or Cashier outside Mobile App. Any errors, delays, or disputes arising from such manual refund transactions are solely the responsibility of Merchant. CUBC will not be held liable for any financial loss, miscommunication, or customer dissatisfaction resulting from refunds processed.

13. AMENDMENT

CUBC reserves the right to modify or update these terms and conditions at any time. any changes will be effective upon posting on the CUBC website or within Mobile App. You continued use of the app after such changes constitutes your acceptance of the modified terms and conditions.

Should Merchant fail to accept a modification to this agreement, Merchant shall terminate this agreement by ceasing all use of the CUBC Merchant (Mobile App) prior to the effective date of such modification and shall comply with all applicable terms and conditions of this agreement.

14. SUSPENSION OR TERMINATION

CUBC may suspend or terminate accessing to the app for any reason, including but not limited to:

• Violation of these terms and conditions such as any breach of the terms outlined in this agreement, such as misuse of the app, fraudulent activity, or unauthorized access.

• Non-compliance with applicable laws and regulations such as any violation of relevant laws, regulations, or industry standards, such as anti-money laundering regulations, data privacy laws, or tax laws.

• Suspicious activity or security breaches such as any activity that is deemed suspicious or poses a security risk, such as unauthorized access attempts, data breaches, or malware infections.

Merchant may suspend or terminate accessing to the app for any reason, including but not limited to:

• Business closure or downsizing, if the business is closing down, scaling back operations significantly, or no longer requires the app's functionalities.

• High fees or unexpected charges, uncompetitive pricing, hidden fees, or unexpected charges that make the app less cost-effective.

• Merchant and business decision, if the business need to.

Settlement of outstanding amounts, Merchant must ensure all outstanding amounts owed to CUBC, such as transaction fees or any other applicable fees or any fees implemented by the bank, are settled in full before or upon termination.

15. GOVERNING LAW AND JURISDICTION

These terms and conditions shall be governed by and construed in accordance with the laws of Cambodia.

Any dispute arising out of or in connection with these terms and conditions shall be submitted to the exclusive jurisdiction of the courts of Phnom Penh, Cambodia.

16. ENTIRE AGREEMENT

These terms and conditions constitute the entire agreement between Merchant and CUBC regarding Merchant use of the app and supersede all prior or contemporaneous communications, representations, or agreements, whether oral or written.

17. SEVERABILITY

If any provision of these terms and conditions is found to be invalid or unenforceable, that provision shall be deemed severable from the remaining provisions, and the remaining provisions shall continue to be in full force and effect.

![]()